Mastering Marriage Finances: Effective Money Management in Marriage Through Joint Accounts and Cooperative Planning

Estimated Reading time: 8 Minutes

"Coming together is a beginning; keeping together is progress; working together is success." – Henry Ford

In marriage, just like in any other partnership, teamwork is essential. This is especially true when it comes to money management, which can be a tricky yet vital aspect of your relationship. Marriage finances refer to the way married couples manage, plan, and make decisions about their money, assets, debts, and financial obligations. When handled effectively, financial management fosters stability, encourages shared achievements, and helps reduce conflict.

The Importance of Financial Planning in Marriage

Planning your finances together is crucial for maintaining a healthy relationship. It helps you and your partner align, set mutual goals, build trust, and tackle challenges as a team. Common strategies include establishing joint accounts and implementing effective money management in marriage practices. By collaborating financially, you can strengthen your bond and enhance your relationship. For more insights on building a strong financial foundation, check out Financial Compatibility: What It Is and How to Strengthen It in Your Relationship.

Source Links:

Understanding Marriage Finances

Aligning Financial Goals as a Couple

Having shared financial goals is fundamental for couples. When both partners work towards objectives—such as saving for retirement, making a down payment on a home, or planning for vacations—it leads to better cooperation and success in achieving those targets.

Source URL: Investopedia - So You're Getting Married

Common Financial Challenges Faced by Married Couples

Married couples often face various challenges when managing their finances:

- Differing Spending Habits: You might prefer to save, while your partner enjoys spending.

- Hidden Debts: One partner may have debts that were not disclosed before marriage.

- Unexpected Expenses: Sudden bills or emergencies can strain your budget.

- Financial Stress or Anxiety: Money issues can lead to emotional strain in the relationship.

- Contrasting Money Values and Beliefs: Differing backgrounds can create conflicting perspectives on financial priorities.

These issues can affect your relationship on both emotional and financial levels.

Source URLs:

Emotional Aspects of Money Management

Money is often tied to feelings of security and trust. It’s essential for couples to openly discuss their financial fears and anxieties. By doing so, you create an atmosphere of transparency and support, which can alleviate apprehensions surrounding finances.

Source URL: ADZ Law - Understanding Finances in Marriage

Setting Up Joint Accounts

Benefits of Having Joint Accounts vs. Individual Accounts

Using joint accounts offers several advantages:

- Streamlined Budgeting: Easier management of shared expenses and bills.

- Increased Financial Transparency: Both partners can see where the money goes.

- Building Trust: Shared responsibility fosters trust in your relationship.

- Simplifying Financial Management: One account for shared expenses means fewer transfers and easier tracking.

However, some couples worry about losing financial independence. To mitigate this, consider maintaining individual accounts for personal expenses alongside the joint account.

Source URL: Investopedia - So You're Getting Married

How to Open a Joint Account

Opening a joint account is a straightforward process:

- Choose a Financial Institution: Research local banks or credit unions with good terms.

- Gather Necessary Documentation: Both partners will need identification, social security numbers, and proof of address.

- Discuss Account Details: Clarify the purpose of the account and spending expectations.

- Complete the Application Process: This can usually be done online or in person. Both partners should sign all documents together.

This process creates a foundation for transparent financial management and teamwork in achieving your financial goals.

The Role of Joint Accounts in Financial Transparency and Trust

Having a joint account means both partners can see the financial activities, reducing the possibility of secrets or misunderstandings. To enhance this transparency, consider setting up regular alerts or reviewing your account statements together. This ensures both partners remain informed and engaged in the financial aspect of the marriage.

Source URL: Investopedia - So You're Getting Married

Money Management Strategies in Marriage

Effective Budget Planning as a Couple

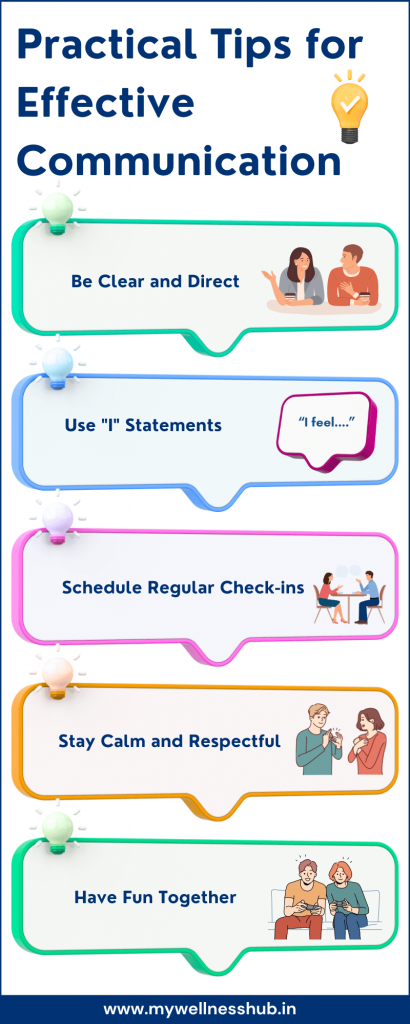

- Regular Financial Discussions: Hold weekly or monthly meetings to review your finances. Create a comfortable environment to allow open dialogue. Essential Premarital Discussion Topics for Building a Strong and Lasting Marriage

- Communication About Spending Habits: Share your individual spending patterns and identify areas where you may be overspending.

- Setting Joint Financial Goals: Outline short-term and long-term objectives, which might include:

- Building an emergency fund

- Saving for a house or vacation

- Paying off debt

- Investing for retirement

This collaboration promotes money management in marriage and ensures both partners engage in financial planning.

Source URL: Investopedia - So You're Getting Married

Handling Individual and Shared Expenses

Consider these approaches to manage expenses fairly:

- Combine All Finances: Treat all income and expenses as shared.

- Maintain Separate Accounts for Individual Expenses: Keep personal spending separate while maintaining a joint account for shared bills.

- Proportional Contributions: If there's a difference in income, agree on proportional contributions to the joint account.

Establishing fairness and respect in these arrangements is essential. Regularly revisit these agreements as circumstances change.

Monitoring and Reviewing Financial Goals Regularly

Utilize budgeting tools or apps (like Mint or YNAB) to track your progress toward financial goals. Celebrate milestones together to stay incentivized, and adjust budgets as needed due to life events like job changes or family growth.

Source URL: Investopedia - So You're Getting Married

Cooperative Financial Planning

Assessing Current Financial Status

Start by compiling a comprehensive list of:

- All income sources

- Any existing debts (like student loans, credit cards, mortgages)

- Assets (savings, investments, property)

- Recurring expenses (utilities, subscriptions, insurance)

Being transparent about your financial health is essential for creating a fruitful partnership.

Creating a Joint Budget

Align your budget to reflect both partners’ priorities and lifestyles. Allocate funds appropriately for necessities (housing, food), savings, investments, and discretionary spending.

Source URL: Investopedia - So You're Getting Married

Importance of Periodic Financial Check-ins

Scheduling regular financial reviews—monthly or quarterly—is crucial. These meetings provide an opportunity to:

- Track your progress towards financial goals

- Discuss any changes in income or expenses

- Adjust budgets as necessary

Both partners should have an equal voice during these discussions, ensuring that you respect each other's opinions and find compromise. For effective conflict resolution in financial matters, refer to Conflict Resolution Strategies: How to Fight Fair and Communicate Effectively in Relationships.

Source URL: Boulay Group - Shared Financial Decision Making

Managing Conflicts Related to Money

Common Conflicts in Marriage Finances

Money can be a source of conflict for many couples, often involving:

- Differences in spending vs. saving

- Risk tolerance in investments

- Financial priorities

- Secretive financial behaviors

Strategies for Resolving Disagreements

- Effective Communication: Address issues early and honestly using "I" statements to express feelings without blame (e.g., "I feel anxious when...").

- Setting Financial Boundaries: Agree on spending limits and require joint approval for large purchases.

- Seeking Professional Help: Don’t hesitate to consult a financial advisor or a marriage therapist specializing in financial matters.

- Practicing Empathy and Compromise: Try to understand your partner's perspective and yield to solutions that honor both partners' values.

Source URL: The Money Couple - Financial Communication

Long-term Financial Goals

Aligning on Major Life Financial Objectives

Discuss your long-term goals together, such as saving for retirement, the education of children, or making real estate investments.

Source URL: Investopedia - So You're Getting Married

Supporting Each Other Towards Financial Independence and Security

Encourage each other’s career development and educational opportunities. Collaborating on long-term financial plans can create a sense of teamwork, leading to a more secure future.

Regularly Revisiting Long-term Plans

As life changes occur (like job transitions or family expansions), revisit and adjust your goals. Keeping each other informed about individual financial decisions that might affect joint plans will strengthen your partnership.

Conclusion

In summary, marriage finances require open communication, goal-setting, and cooperative planning. Working together towards shared financial objectives enhances the health of your relationship. As you navigate the complexities of finances, remember that decision-making is not just about money—it’s about trust, partnership, and love.

Call-to-Action

Start a financial conversation with your partner today! Plan a date for your first financial planning meeting, and take the first steps towards mastering your marriage finances together.

Additional Resources

Recommended Books

- The Total Money Makeover by Dave Ramsey

- Smart Couples Finish Rich by David Bach

Online Tools

Budgeting Apps:

- Mint: A free app to track expenses and create budgets. Mint

- YNAB (You Need A Budget): A paid app focused on proactive budgeting. YNAB

Worksheets: Printable budget planners and templates are available from financial websites. Dave Ramsey's Budgeting Forms

Additional Tips

Consider attending workshops or financial seminars specifically aimed at couples. You might even find resources offered by your employer, such as financial wellness programs.

By actively engaging in these strategies and utilizing available resources, you and your partner can confidently navigate the challenges of marriage finances, creating a partnership that thrives both emotionally and financially.

Tags:

Marriage Finances Money Management Joint Accounts Financial Planning Couple Goals-

What to include in my Wedding Website

What to include in my Wedding WebsiteDream Wedds

-

How Engagement Party should be celebrated

How Engagement Party should be celebratedLeonard Bernstein

-

Elevate Your Haldi and Mehandi Ceremony Glam

Elevate Your Haldi and Mehandi Ceremony GlamNeeraj Singh

-

-

-

-

-

-

-

-

-

-

-

YOUR BIO AND HOW WE MET

YOUR BIO AND HOW WE METLeonard Bernstein

-

-

-

-

-

A Guide to Health, Wellness post Marriage

A Guide to Health, Wellness post MarriageSaujanya Bose

-

-

-

-

-

-

-

-

-

-

-

-

-

Personal Space: The Key to a Healthy and Balanced Marriage

Personal Space: The Key to a Healthy and Balanced MarriageDreamWedds Team

-

-

-

Fade Dark Spots: Natural Remedies and Tips for Clearer Skin

Fade Dark Spots: Natural Remedies and Tips for Clearer SkinDreamWedds Team

-

-

Selecting the Perfect Foundation Shade: Your Ultimate Guide

Selecting the Perfect Foundation Shade: Your Ultimate GuideDreamWedds Team

-

-

-

-

-

Health and Wellness for Brides and Grooms

Health and Wellness for Brides and GroomsDreamWedds

-

-

-

-

-

The Ultimate Guide to Achieving Long-Lasting Bridal Makeup

The Ultimate Guide to Achieving Long-Lasting Bridal MakeupDreamWedds Team

-

-

-

-

-

-

:max_bytes(150000):strip_icc()/Kitzcornermedium-c9abd848ea634040a06bb6db8b8a7304.jpg)

-

-

-

-

-

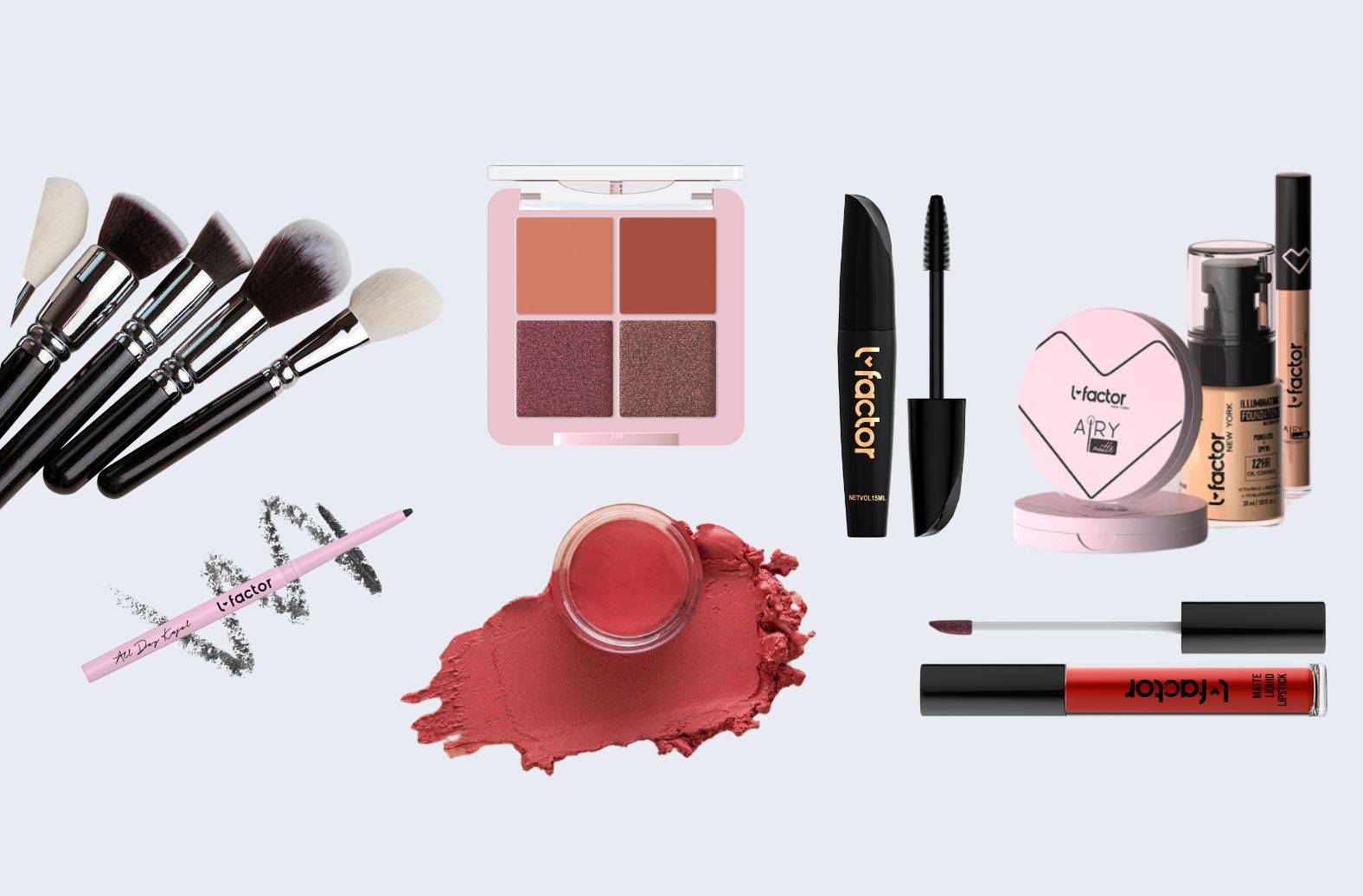

Makeup Basics: Essential Cosmetics Every Beginner Should Own

Makeup Basics: Essential Cosmetics Every Beginner Should OwnDreamWedds Team

-

-

-

-

The Ultimate Wedding Planning Checklist for Indian Weddings

The Ultimate Wedding Planning Checklist for Indian WeddingsSimranpreet Singh

-

-

-

-

Virat & Anushka: A Fairytale Wedding to Remember!

Virat & Anushka: A Fairytale Wedding to Remember!Yashashvi Mathur

-

-

-

The Importance of a Bridal Makeup Trial for Your Wedding Day

The Importance of a Bridal Makeup Trial for Your Wedding DayDreamWedds Team

-

-

-

-

-

Effective Natural Skincare Remedies to Reduce Pore Size

Effective Natural Skincare Remedies to Reduce Pore SizeDreamWedds Team