Mastering Marriage Finances: A Comprehensive Guide to Money Management in Marriage

Estimated Reading Time: 8 Minutes

"Coming together is a beginning; keeping together is progress; working together is success." – Henry Ford

Navigating marriage finances can be a complex journey, but with the right strategies, couples can achieve financial harmony and strengthen their relationship. Managing finances in a marriage is crucial for building a stable and fulfilling partnership. When couples effectively manage money together, they reduce stress and prevent conflicts. It’s no secret that finances are one of the top causes of marital disagreements, making proactive management essential.

In this blog post, we will explore practical strategies for managing marriage finances effectively. You will learn about the benefits of joint accounts, alternative financial arrangements, effective money management strategies in marriage, and techniques for financial planning and conflict resolution. Let’s dive into mastering the art of marriage finances together!

Understanding Marriage Finances

What are Marriage Finances?

Marriage finances encompass all financial activities and decisions impacting both partners. This includes:

- Combining incomes and managing shared expenses: Couples share household costs such as rent, utilities, and groceries.

- Coordinating savings, investments, and debt repayment: Together, partners can decide how to allocate funds for savings, investments, and pay down debt.

- Setting and working toward joint financial goals: Couples establish shared objectives, such as buying a home or planning for retirement.

Why are Marriage Finances Important?

Managing finances in a marriage is crucial because it directly impacts the overall quality of life and relationship satisfaction. Financial stability fosters trust, transparency, and teamwork between spouses (Financial Compatibility: What It Is and How to Strengthen It in Your Relationship). Couples who collaborate on financial matters build a deeper connection, making it easier to navigate other aspects of their relationship. "Financial matters in marriage are crucial because they directly impact quality of life, future planning, and even the stability of the relationship." – Investopedia.

Common Financial Challenges Married Couples Face

Every couple encounters financial challenges. Here are some common hurdles:

- Different spending or saving habits: For example, one partner may prioritize saving for the future, while the other enjoys spending on immediate pleasures. This disparity can lead to disagreements over budgeting and financial priorities.

- Unclear communication regarding financial priorities: Without open discussions, partners may assume too much about each other’s financial expectations. Misalignments can create conflicts when unexpected expenses or decisions arise.

- Disagreements on debt management or major purchases: Differing opinions on handling existing debts (like student loans) or taking on new debts (like a mortgage) can strain both partners (Conflict Resolution Strategies: How to Fight Fair and Communicate Effectively in Relationships).

- Setting and achieving joint financial goals: Challenges may arise when aligning long-term objectives, like saving for a house, retirement, or children’s education. Lack of a shared vision can hinder progress and create tension.

Recognizing and addressing these challenges is vital for effective money management in marriage.

The Benefits of Joint Accounts

What are Joint Accounts?

A joint account is a bank account shared by both spouses, granting equal access to funds. This means both partners can deposit, withdraw, and manage money from the account together.

Advantages of Having Joint Accounts

Here are some key benefits of joint accounts:

- Promote transparency in financial transactions: Both partners can see all account activity, effectively reducing the chance of hidden spending. This transparency builds trust.

- Simplify household budgeting and expense tracking: Consolidating finances makes it easier to monitor income and expenses, facilitating the creation of a unified budget.

- Foster teamwork and mutual responsibility in managing money: Joint accounts encourage joint decision-making and shared accountability which strengthens the partnership.

- Ease of paying shared bills and saving for combined goals: A joint account streamlines the process of managing expenses and saving for joint objectives, such as vacations or home purchases.

Research confirms that joint accounts can increase transparency, but couples should also be aware of their individual needs. "Joint accounts can increase transparency, but some couples value the autonomy of separate accounts. Finding the right balance often depends on communication and trust." – Boulay Group.

In fact, having a joint account makes it easier to handle expenses: "Having joint accounts makes it easier to pay shared bills, save for combined goals, and handle emergencies." – Investopedia.

Money Management Strategies in Marriage

Effective Money Management Strategies for Couples

Couples can utilize various money management strategies in marriage to maintain financial harmony:

- Develop a joint budget: Combine both partners' incomes to create a comprehensive budget. Outline all expenses, including fixed costs (like mortgage/rent) and variable costs (like entertainment). Also, allocate funds for savings, investments, and emergency funds. Then review and adjust the budget regularly.

- Establish shared savings and investment plans: Set mutual financial goals, such as buying a house or planning for retirement. Also, explore investment options that align with both partners' risk tolerance (Career and Marriage: Tips for Achieving Balance and Thriving Together). Consulting a financial advisor for personalized guidance can be beneficial.

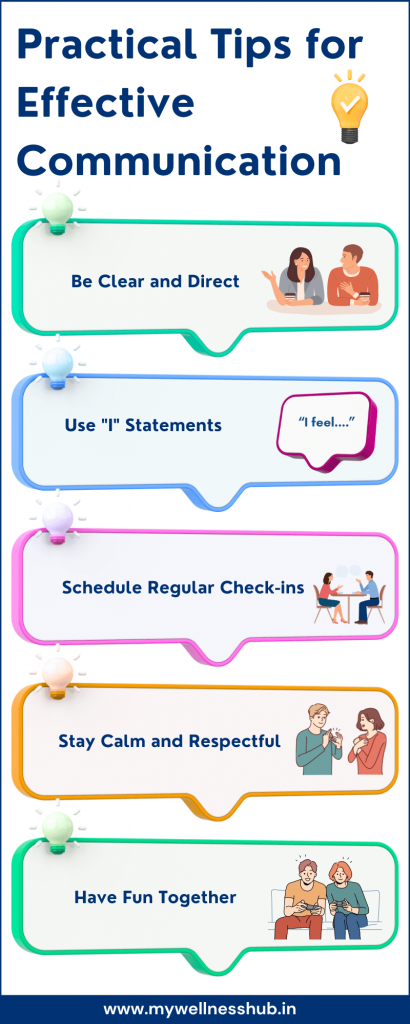

- Regular financial check-ins: Schedule monthly or quarterly meetings to discuss financial status. Review expenditures, track progress toward goals, and address any concerns. Open communication is key to preventing misunderstandings.

- Utilize financial tools and resources: Budgeting apps or software can help track expenses and manage accounts. Educating yourselves on financial topics through books, courses, or workshops provides valuable knowledge.

Communication is paramount in these strategies. When partners engage in open dialogue about finances, they reduce surprises and build trust.

Regularly reviewing financial statuses and plans can help couples adapt as life changes occur, such as new jobs or children. "Regularly review financial status and adjust plans as life changes occur, such as new jobs or the birth of a child." – Guardian Life.

Alternative Models to Joint Accounts

Exploring Other Financing Models

While joint accounts work for many, other options exist for managing finances in marriage:

- Maintaining separate accounts while having a shared account for joint expenses: Each partner retains individual accounts for personal spending while both contribute to a joint account for shared bills and savings. This approach allows for autonomy while managing shared responsibilities.

- Dividing responsibilities for specific types of expenses: Assign certain bills to each partner (e.g., one partner handles housing costs while the other covers utilities and groceries). This arrangement ensures that both partners contribute to the household in mutually agreed-upon ways.

- Proportional contribution based on income: Partners contribute to joint expenses proportionally based on their income. This method balances contributions fairly when there are significant income disparities.

Merits and Challenges of Each Model

Each model has its merits and challenges:

- Merits:

- Separate accounts provide personal freedom and prevent conflicts over individual spending.

- Shared accounts promote unity and simplify financial management.

- Hybrid approaches offer a balance between independence and collaboration.

- Challenges:

- Separate accounts may lead to less transparency and potential financial secrets.

- Shared accounts require a high level of trust and consistent communication.

- Differences in financial views can strain any system without open dialogue.

Ultimately, the importance of communication and trust cannot be overstated. Regular discussions ensure both partners are satisfied with the arrangement and maintain flexibility to adjust as life circumstances change.

Financial Planning for the Future

The Significance of Long-Term Financial Goals

Discussing long-term financial goals is vital for couples. Here are common goals they may consider:

- Saving for home ownership: Couples should estimate the required down payment and associated costs, determine a savings timeline, and research mortgage options.

- Planning for retirement: It's essential to explore retirement accounts (e.g., 401(k), IRA), contribution limits, and desired lifestyles during retirement to estimate needed savings.

- Funding children’s education: Evaluating education savings plans like 529 accounts and factoring in potential education costs and inflation is crucial.

Aligning both financial priorities ensures marital partners work toward shared dreams while adapting to various life changes. For instance, setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals together can guide this endeavor (Essential Premarital Discussion Topics for Building a Strong and Lasting Marriage).

Managing Conflicts Related to Finances

Common Sources of Disagreement

Money can be a major source of conflict in marriage. Common triggers include:

- Differing approaches to saving and spending: Conflicts can occur between a partner who is frugal and another who spends freely.

- Hidden debts or undisclosed financial activities: Secrets regarding credit card debts, loans, or major purchases can lead to distrust in a relationship.

- Income disparities and perceived power imbalances: The partner who earns more may feel entitled to make more decisions, while the lower-earning partner might feel undervalued.

Tips for Managing and Resolving Financial Conflicts

To navigate and resolve financial disagreements, consider these tips:

- Open communication about individual attitudes and concerns: Discuss your money histories and how they influence current behavior. Be transparent about fears, aspirations, and expectations.

- Willingness to compromise and adjust expectations: Couples should be open to finding middle ground on spending and saving habits, agreeing to budget adjustments that satisfy both partners.

- Establish ground rules for financial decisions: Set spending limits that require joint approval for purchases above a certain amount and determine protocols for borrowing or lending money.

- Seek professional advice if necessary: Financial advisors can provide objective views, and marriage counselors can help address deeper relationship issues concerning money (The Benefits of Premarital Counseling: Building a Strong Foundation for Marriage).

Addressing issues early is essential to preventing escalation. Regular financial check-ins foster pivotal discussions and create opportunities to tackle small problems before they grow.

Conclusion

Effective money management in marriage fosters trust, reduces stress, and contributes to a strong relationship. Proactively managing marriage finances ensures both partners work as a team, overcoming challenges together and building a foundation for a secure and happy life.

By taking actionable steps now, couples can start conversations about their financial situation, establish joint budgets, or explore financial planning resources together.

Finally, remember that approaching financial matters collaboratively is an expression of mutual love and respect. "By approaching financial matters together, couples can overcome challenges, achieve their goals, and foster long-term security and happiness." – Investopedia.

Call to Action

What strategies have you and your partner found effective in managing your marriage finances? Share your experiences, challenges, and successes in the comments below. Let’s build a supportive community where couples can learn from each other as they navigate these important conversations!

Tags:

Marriage Finances Money Management Relationships Financial Planning Conflict Resolution-

What to include in my Wedding Website

What to include in my Wedding WebsiteDream Wedds

-

How Engagement Party should be celebrated

How Engagement Party should be celebratedLeonard Bernstein

-

Elevate Your Haldi and Mehandi Ceremony Glam

Elevate Your Haldi and Mehandi Ceremony GlamNeeraj Singh

-

-

-

-

-

-

-

-

-

-

-

YOUR BIO AND HOW WE MET

YOUR BIO AND HOW WE METLeonard Bernstein

-

-

-

-

-

A Guide to Health, Wellness post Marriage

A Guide to Health, Wellness post MarriageSaujanya Bose

-

-

-

-

-

-

-

-

-

-

-

-

-

Personal Space: The Key to a Healthy and Balanced Marriage

Personal Space: The Key to a Healthy and Balanced MarriageDreamWedds Team

-

-

-

Fade Dark Spots: Natural Remedies and Tips for Clearer Skin

Fade Dark Spots: Natural Remedies and Tips for Clearer SkinDreamWedds Team

-

-

Selecting the Perfect Foundation Shade: Your Ultimate Guide

Selecting the Perfect Foundation Shade: Your Ultimate GuideDreamWedds Team

-

-

-

-

-

Health and Wellness for Brides and Grooms

Health and Wellness for Brides and GroomsDreamWedds

-

-

-

-

-

The Ultimate Guide to Achieving Long-Lasting Bridal Makeup

The Ultimate Guide to Achieving Long-Lasting Bridal MakeupDreamWedds Team

-

-

-

-

-

-

:max_bytes(150000):strip_icc()/Kitzcornermedium-c9abd848ea634040a06bb6db8b8a7304.jpg)

-

-

-

-

-

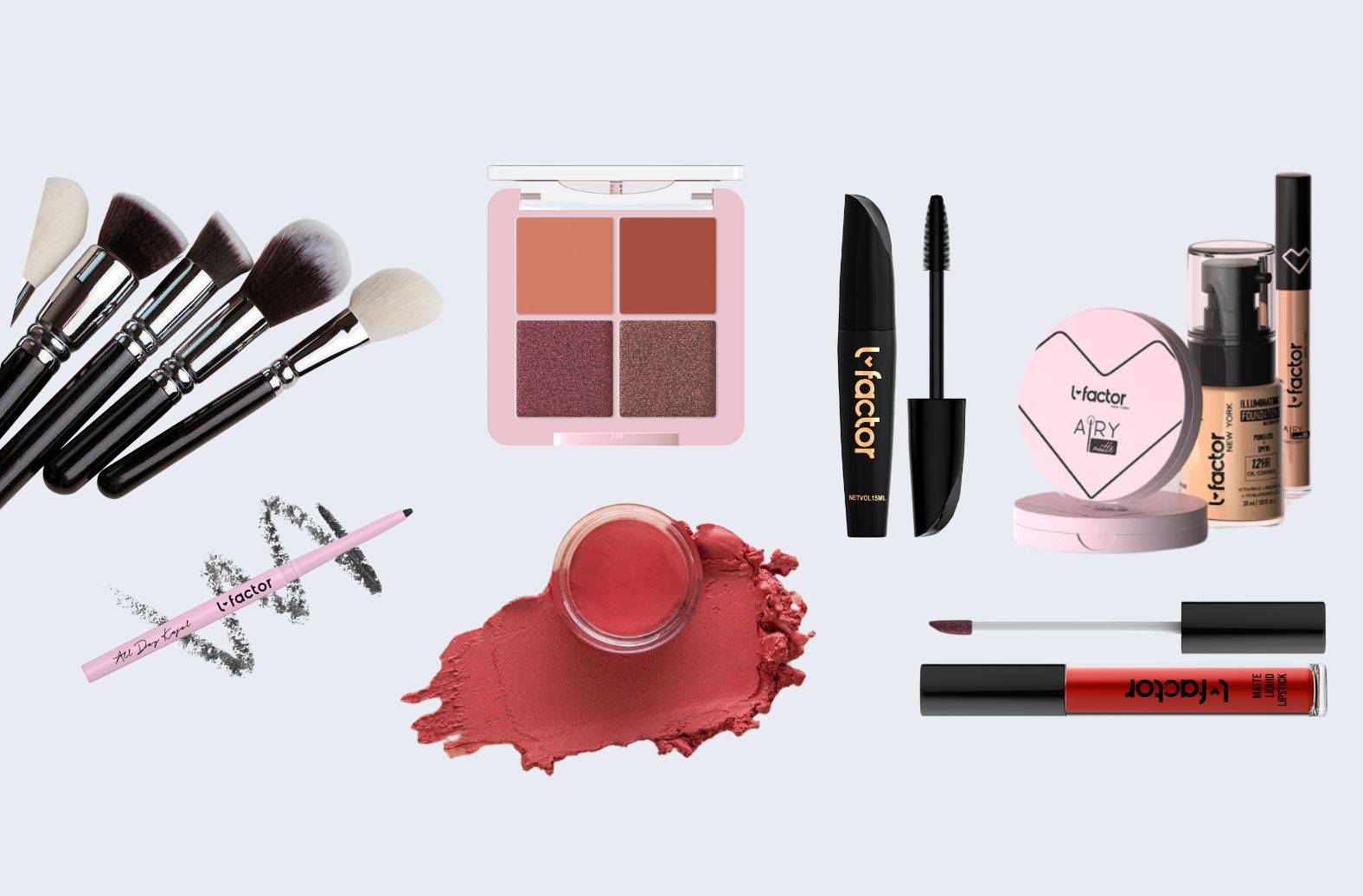

Makeup Basics: Essential Cosmetics Every Beginner Should Own

Makeup Basics: Essential Cosmetics Every Beginner Should OwnDreamWedds Team

-

-

-

-

The Ultimate Wedding Planning Checklist for Indian Weddings

The Ultimate Wedding Planning Checklist for Indian WeddingsSimranpreet Singh

-

-

-

-

Virat & Anushka: A Fairytale Wedding to Remember!

Virat & Anushka: A Fairytale Wedding to Remember!Yashashvi Mathur

-

-

-

The Importance of a Bridal Makeup Trial for Your Wedding Day

The Importance of a Bridal Makeup Trial for Your Wedding DayDreamWedds Team

-

-

-

-

-

Effective Natural Skincare Remedies to Reduce Pore Size

Effective Natural Skincare Remedies to Reduce Pore SizeDreamWedds Team